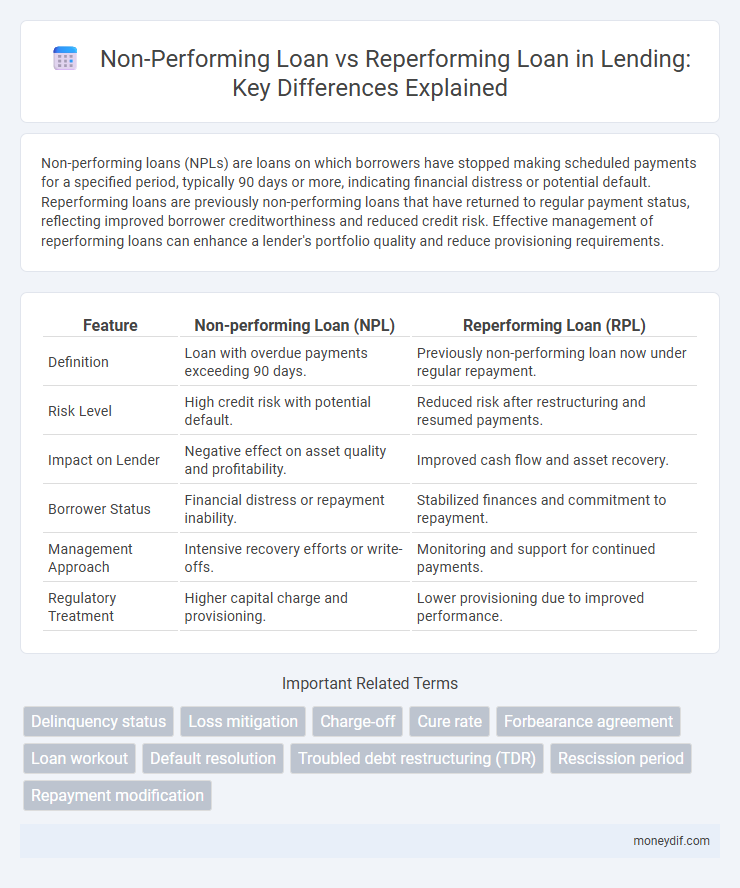

Non-performing loans (NPLs) are loans on which borrowers have stopped making scheduled payments for a specified period, typically 90 days or more, indicating financial distress or potential default. Reperforming loans are previously non-performing loans that have returned to regular payment status, reflecting improved borrower creditworthiness and reduced credit risk. Effective management of reperforming loans can enhance a lender's portfolio quality and reduce provisioning requirements.

Table of Comparison

| Feature | Non-performing Loan (NPL) | Reperforming Loan (RPL) |

|---|---|---|

| Definition | Loan with overdue payments exceeding 90 days. | Previously non-performing loan now under regular repayment. |

| Risk Level | High credit risk with potential default. | Reduced risk after restructuring and resumed payments. |

| Impact on Lender | Negative effect on asset quality and profitability. | Improved cash flow and asset recovery. |

| Borrower Status | Financial distress or repayment inability. | Stabilized finances and commitment to repayment. |

| Management Approach | Intensive recovery efforts or write-offs. | Monitoring and support for continued payments. |

| Regulatory Treatment | Higher capital charge and provisioning. | Lower provisioning due to improved performance. |

Understanding Non-Performing Loans (NPLs)

Non-performing loans (NPLs) are loans on which borrowers have failed to make scheduled payments for 90 days or more, signaling potential credit risk to lenders. These loans significantly impact a financial institution's balance sheet by tying up capital and increasing provisioning costs, hindering new credit issuance. Understanding the classification and management of NPLs, including the transition to reperforming loans when timely payments resume, is crucial for effective risk assessment and loan portfolio optimization.

Defining Reperforming Loans (RPLs)

Reperforming loans (RPLs) are loans that were previously classified as non-performing due to missed payments or default but have since resumed regular repayments and improved credit status. Unlike non-performing loans (NPLs), which indicate borrower distress and increased risk of default, RPLs demonstrate recovery potential and improved cash flow for lenders. Financial institutions prioritize identifying RPLs to optimize asset quality and reduce loan loss provisions in their portfolios.

Key Differences Between NPLs and RPLs

Non-performing loans (NPLs) are debt obligations where borrowers have failed to make scheduled payments for 90 days or more, indicating significant credit risk and potential default. Reperforming loans (RPLs) are previously non-performing loans that have resumed regular payment schedules, reflecting improved borrower financial health and reduced credit risk. The key differences between NPLs and RPLs lie in payment status, risk assessment, and impact on lender's asset quality and provisioning requirements.

Causes of Non-Performing Loans

Non-performing loans (NPLs) arise primarily from borrower defaults due to economic downturns, poor credit assessment, and deteriorating financial conditions. Reperforming loans result when previously non-performing loans are brought back to regular status through restructuring or improved repayment capacity. Causes of non-performing loans include high-interest rates, inadequate collateral, and external shocks affecting borrowers' ability to repay.

How Loans Transition to Reperforming Status

Non-performing loans (NPLs) transition to reperforming status through consistent borrower repayments and restructuring agreements that restore regular payment schedules. Lenders monitor improved borrower financial conditions and adherence to modified loan terms to reclassify loans as reperforming, reducing credit risk. Effective loan workout strategies and timely intervention accelerate this recovery process, enhancing asset quality and capital adequacy ratios.

Impact of NPLs on Lenders and Investors

Non-performing loans (NPLs) significantly reduce lenders' liquidity and capital adequacy, forcing higher provisioning that erodes profitability and weakens balance sheets. Reperforming loans improve cash flow stability and asset quality, mitigating risk and enhancing investor confidence. Persistent NPLs inflate credit risk premiums, increase funding costs, and limit access to capital markets for financial institutions.

Risk Assessment: NPLs vs RPLs

Non-performing loans (NPLs) represent high credit risk as borrowers have failed to meet payment obligations for 90 days or more, signaling potential default and significant losses for lenders. Reperforming loans (RPLs), previously classified as NPLs, show improved payment behavior and reduced risk through consistent repayments after restructuring or recovery efforts. Effective risk assessment differentiates NPLs from RPLs by evaluating payment history, borrower creditworthiness, and likelihood of continued performance to optimize loan portfolio management.

Strategies for Managing Non-Performing Loans

Effective strategies for managing non-performing loans (NPLs) include loan restructuring, where terms such as interest rates and repayment schedules are adjusted to improve borrower affordability and restore loan performance. Implementing rigorous credit risk assessment and early warning systems helps identify potential defaults, enabling timely intervention before loans become non-performing. Additionally, banks often employ asset recovery and legal actions to minimize losses from unrecoverable NPLs, while reperforming loans are monitored closely to ensure sustained repayment behavior.

Benefits and Challenges of Reperforming Loans

Reperforming loans offer significant benefits such as improved cash flow and reduced credit risk by converting non-performing assets into performing ones through timely repayments. They enhance borrower credit profiles and increase lender recovery rates while fostering stronger borrower-lender relationships. Challenges include the need for rigorous monitoring, potential restructuring costs, and the risk of redefault, which require effective risk management strategies to maximize loan performance.

Market Trends in NPL and RPL Investments

Non-performing loan (NPL) markets have shown increased investor interest due to regulatory efforts and improving recovery rates, driving significant asset portfolio transactions globally. Reperforming loans (RPLs) are gaining traction as banks restructure distressed debt and borrowers resume payments, enhancing portfolio value and reducing non-performing loan ratios. Market trends indicate a shift towards RPL investments as they offer lower risk profiles and steady cash flows compared to traditional NPL assets.

Important Terms

Delinquency status

Delinquency status categorizes loans based on overdue payments, distinguishing non-performing loans (NPLs), which are severely delinquent and unlikely to be repaid on time, from reperforming loans that transition back to good standing after resolving delayed payments. Tracking these statuses is crucial for assessing credit risk, portfolio quality, and financial institution stability.

Loss mitigation

Loss mitigation strategies focus on minimizing financial losses from non-performing loans (NPLs), which are loans in default or close to default, whereas reperforming loans refer to previously delinquent loans that have resumed regular payments and improved borrower credit profiles. Effective loss mitigation techniques such as debt restructuring, loan modifications, and repayment plans can convert non-performing loans into reperforming loans, thereby enhancing the lender's asset quality and reducing credit risk.

Charge-off

Charge-off occurs when a non-performing loan, which remains unpaid for a specified period usually 90 days or more, is written off as a loss by the lender. In contrast, a reperforming loan transitions from non-performing status back to performing, indicating the borrower has resumed regular payments and the loan is no longer classified as a credit loss risk.

Cure rate

The cure rate measures the percentage of non-performing loans (NPLs) that return to performing status within a specific period, reflecting the effectiveness of loan recovery efforts. Higher cure rates indicate successful transition from non-performing to reperforming loans, reducing credit risk and improving portfolio quality for financial institutions.

Forbearance agreement

A forbearance agreement is a strategic arrangement between lenders and borrowers to temporarily suspend or reduce loan payments on non-performing loans, aiming to avoid default and facilitate loan restructuring. When successful, this agreement transitions the loan status from non-performing to reperforming by restoring regular payment schedules, improving borrower credit profiles and lender recovery rates.

Loan workout

Loan workout strategies focus on restructuring non-performing loans (NPLs) to recover value by converting them into reperforming loans, thereby enhancing cash flow and reducing credit risk. Effective management of NPLs through tailored repayment plans and renegotiated terms transforms distressed assets into performing ones, improving overall portfolio quality and financial stability.

Default resolution

Default resolution involves strategies to manage non-performing loans (NPLs) by either restructuring them into reperforming loans, thereby restoring cash flow through modified payment terms, or through recovery mechanisms like collateral liquidation. Effective resolution reduces the credit risk on a bank's balance sheet, improves asset quality, and enhances financial stability by converting distressed debt into performing assets.

Troubled debt restructuring (TDR)

Troubled debt restructuring (TDR) occurs when a lender modifies the terms of a non-performing loan (NPL) to improve the borrower's ability to repay, often converting it into a reperforming loan by reducing interest rates, extending maturities, or forgiving principal. This process aims to minimize credit losses by restoring the loan's performance status and improving the borrower's financial stability.

Rescission period

The rescission period crucially impacts the management of non-performing loans (NPLs), as it allows borrowers a specific timeframe to reconsider and cancel loan agreements, potentially preventing default status. Efficient handling of rescission periods can aid financial institutions in converting NPLs into reperforming loans by facilitating loan restructuring and recovery efforts within regulatory compliance.

Repayment modification

Repayment modification restructures the terms of a non-performing loan (NPL) to improve borrower capacity, often converting it into a reperforming loan (RPL) by adjusting interest rates, extending loan tenure, or deferring payments to restore regular repayments. Efficient repayment modification strategies enhance asset quality, reduce default risks, and improve cash flow for financial institutions managing distressed loan portfolios.

Non-performing loan vs Reperforming loan Infographic

moneydif.com

moneydif.com