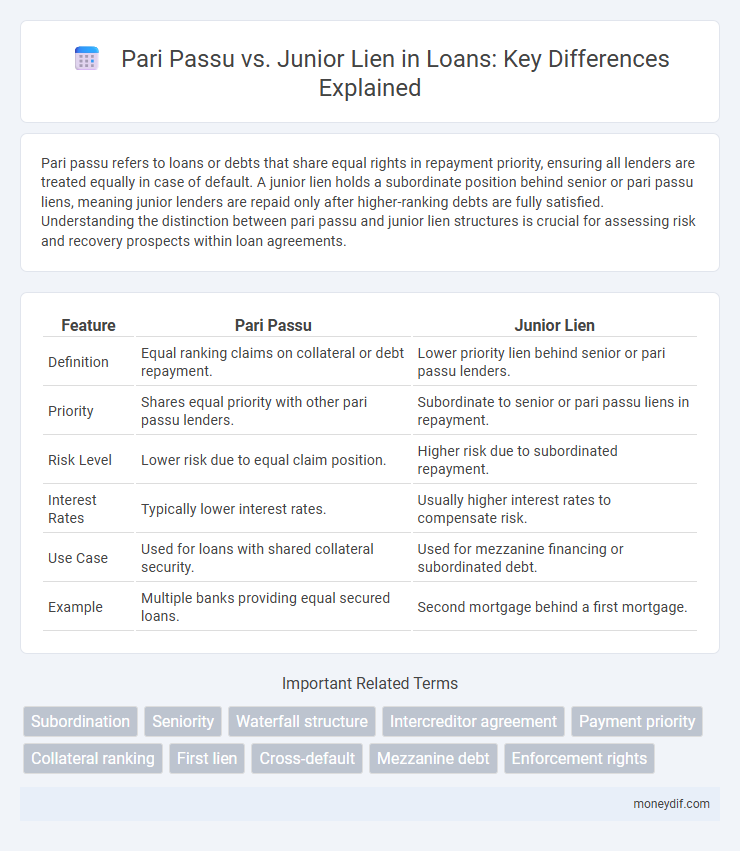

Pari passu refers to loans or debts that share equal rights in repayment priority, ensuring all lenders are treated equally in case of default. A junior lien holds a subordinate position behind senior or pari passu liens, meaning junior lenders are repaid only after higher-ranking debts are fully satisfied. Understanding the distinction between pari passu and junior lien structures is crucial for assessing risk and recovery prospects within loan agreements.

Table of Comparison

| Feature | Pari Passu | Junior Lien |

|---|---|---|

| Definition | Equal ranking claims on collateral or debt repayment. | Lower priority lien behind senior or pari passu lenders. |

| Priority | Shares equal priority with other pari passu lenders. | Subordinate to senior or pari passu liens in repayment. |

| Risk Level | Lower risk due to equal claim position. | Higher risk due to subordinated repayment. |

| Interest Rates | Typically lower interest rates. | Usually higher interest rates to compensate risk. |

| Use Case | Used for loans with shared collateral security. | Used for mezzanine financing or subordinated debt. |

| Example | Multiple banks providing equal secured loans. | Second mortgage behind a first mortgage. |

Understanding Pari Passu and Junior Lien: Key Differences

Pari passu refers to creditors holding equal rights to a borrower's assets without priority over each other, ensuring proportional repayment in loan agreements. Junior lien represents a subordinate claim where the lienholder's rights rank below senior liens, impacting repayment priority during default. Understanding these distinctions is crucial for assessing risk and recovery prospects in loan structuring and debt management.

What Does Pari Passu Mean in Loan Agreements?

Pari passu in loan agreements means that multiple creditors have equal rights to repayment and collateral claims without any preference or subordination. This equal ranking ensures that all lenders are paid proportionally and simultaneously in the event of default or liquidation. Unlike a junior lien, which is subordinate and paid after senior debts, pari passu loans share the same priority level.

Defining Junior Lien: Position in Debt Hierarchy

A junior lien is a type of loan secured by collateral but ranks below senior liens or pari passu debts in the debt hierarchy, meaning it gets repaid after higher-priority claims in the event of borrower default. This subordinate position increases the risk for junior lien holders, often resulting in higher interest rates to compensate for the potential delayed or reduced recovery. Understanding the distinction between junior liens and pari passu arrangements is critical for lenders assessing repayment priorities and risk exposure.

Priority of Claims: Pari Passu vs Junior Lien Explained

Pari passu loans share equal priority in claims, meaning all creditors are paid simultaneously from the borrower's assets in case of default. Junior lien loans hold subordinate priority, receiving payment only after senior debts, including pari passu creditors, are fully satisfied. Understanding the distinction in claim hierarchy is crucial for lenders assessing risk exposure and recovery prospects in loan agreements.

Risk Analysis: Pari Passu vs Junior Lien Debt Structures

Pari passu debt holders share equal ranking and claim on collateral, reducing risk through proportional recovery in default scenarios. Junior lien debt, ranked below senior obligations, carries higher default risk but typically offers higher returns to compensate lenders. Analyzing the risk-adjusted return profile is essential for lenders when choosing between pari passu and junior lien structures in loan portfolios.

Implications for Lenders: Pari Passu and Junior Lien Loans

Pari passu loans grant lenders equal claim on the borrower's assets, ensuring proportional repayment in case of default, which reduces priority disputes and mitigates credit risk. Junior lien loans hold subordinate claims, exposing lenders to higher risk due to their repayment ranking after senior debts, often resulting in higher interest rates to compensate. Understanding these distinctions guides lenders in assessing risk exposure, recovery prospects, and strategic loan structuring.

Borrower Considerations: Choosing Between Pari Passu and Junior Lien

Borrowers must evaluate risk exposure and repayment priority when choosing between pari passu and junior lien structures, as pari passu ensures equal ranking among creditors, minimizing default risk for lenders. Junior liens subordinate the borrower's obligations, potentially increasing interest rates due to higher lender risk but allowing greater flexibility in securing additional financing. Understanding the impact on cash flow priorities and refinancing options is critical for optimizing capital structure and maintaining creditworthiness.

Legal Enforceability: Pari Passu versus Junior Lien Provisions

Pari passu clauses ensure that multiple creditors share equal legal priority and enforce equal claims on collateral, enhancing their collective security in loan agreements. In contrast, junior lien provisions establish a subordinate legal claim, granting senior lienholders superior rights to collateral enforcement, which can limit recovery for junior creditors in default scenarios. Legal enforceability of pari passu clauses often faces scrutiny due to jurisdictional variations, whereas junior liens are typically upheld with clear hierarchical enforcement protocols.

Real-World Examples: Applying Pari Passu and Junior Lien in Practice

In real-world lending scenarios, pari passu clauses ensure that multiple lenders share equal priority in repayment, often seen in syndicated loans where creditors have proportional claims. Junior liens, commonly used in mezzanine financing, subordinate the lender's claim to senior creditors, increasing risk but allowing higher interest rates. Companies like Tesla have utilized junior liens to raise capital without jeopardizing senior loan agreements, while pari passu arrangements are prevalent in large infrastructure project financing to balance risk among participants.

Pros and Cons: Evaluating Pari Passu and Junior Lien in Loan Structuring

Pari passu loans provide equal ranking among lenders, enhancing borrower appeal through simplified repayment priority but may limit flexibility in credit agreements. Junior liens, ranked below senior debt, offer lower interest rates for borrowers due to higher risk while giving lenders secondary claims on assets, which can lead to reduced recovery in default. Evaluating loan structure involves balancing pari passu's equal claim benefits against junior lien's risk-adjusted costs and collateral hierarchy.

Important Terms

Subordination

Subordination in finance refers to the priority ranking of debt obligations, where a junior lien is subordinate to pari passu debt, meaning the junior lien is paid after pari passu creditors in case of default. Pari passu, Latin for "on equal footing," ensures equal payment priority among creditors holding similar claims, unlike junior liens which have a lower repayment priority.

Seniority

Seniority in debt structures determines the repayment priority, with pari passu lenders sharing equal claim on collateral and junior lien holders having subordinated rights behind senior debt. This hierarchy influences risk exposure, recovery rates, and interest rates, where senior or pari passu debt commands lower yields compared to higher-risk junior liens.

Waterfall structure

Waterfall structure prioritizes payment distribution, where pari passu debt holders receive payments simultaneously, whereas junior lien holders are paid after senior obligations are satisfied. This hierarchy ensures senior lien creditors have first claim on cash flows before subordinate claims participate.

Intercreditor agreement

An Intercreditor agreement establishes the priority and rights between lenders, clearly defining the treatment of Pari Passu creditors who share equal ranking and Junior lienholders who hold subordinate claims on collateral. This legal framework ensures structured debt repayment hierarchy, reducing conflicts during borrower default by specifying enforcement rights, payment priorities, and lien subordination.

Payment priority

Payment priority determines the order in which creditors receive payments, with pari passu debts sharing equal ranking and being paid simultaneously, while junior liens are subordinate and receive payment only after senior obligations are fully satisfied. Understanding the distinction between pari passu and junior lien structures is crucial for assessing credit risk and recovery prospects in debt financing.

Collateral ranking

Collateral ranking determines the priority of claims on an asset, with pari passu indicating equal ranking among creditors, while junior lien holders have subordinate claims ranking below senior liens. In default scenarios, pari passu creditors share proportional recovery, whereas junior lien holders receive payment only after senior lien obligations are fully satisfied.

First lien

First lien represents the primary secured claim on an asset, holding priority over all other liens including junior liens, which have subordinated claims in case of default. In pari passu arrangements, multiple creditors share equal priority without preferential treatment, whereas a junior lien is explicitly ranked below the first lien, resulting in lower recovery in liquidation scenarios.

Cross-default

Cross-default clauses trigger a default if a borrower fails to meet obligations on any debt, ensuring pari passu creditors maintain equal claim priority compared to junior lien holders who hold subordinate security interests; this mechanism protects senior lenders by accelerating debt obligations across multiple agreements. In contrast, junior lien creditors face higher risk due to their lower priority in repayment, making cross-default provisions critical in preserving creditor hierarchy and safeguarding pari passu status in multi-layered capital structures.

Mezzanine debt

Mezzanine debt occupies a subordinated position between senior debt and equity, typically ranked junior to senior secured loans but senior to common equity in the capital structure. It often shares a pari passu ranking with other junior liens, ensuring equal repayment priority among similar debt holders in the event of default.

Enforcement rights

Enforcement rights determine the priority of creditors in case of default, where pari passu status ensures equal claims among lenders, while a junior lien ranks below senior liens and is only enforceable after senior debt is satisfied. Junior lien holders face higher risk and limited enforcement options compared to pari passu creditors who share proportional recovery rights simultaneously.

Pari passu vs Junior lien Infographic

moneydif.com

moneydif.com