Bullet repayment requires the borrower to pay the entire principal amount at the end of the loan term, often resulting in lower monthly payments but a large lump sum due at maturity. Instalment repayment spreads the principal and interest over regular monthly payments, making budgeting easier and reducing the risk of a large payment shock. Choosing between bullet and instalment repayment depends on cash flow preferences and financial stability during the loan period.

Table of Comparison

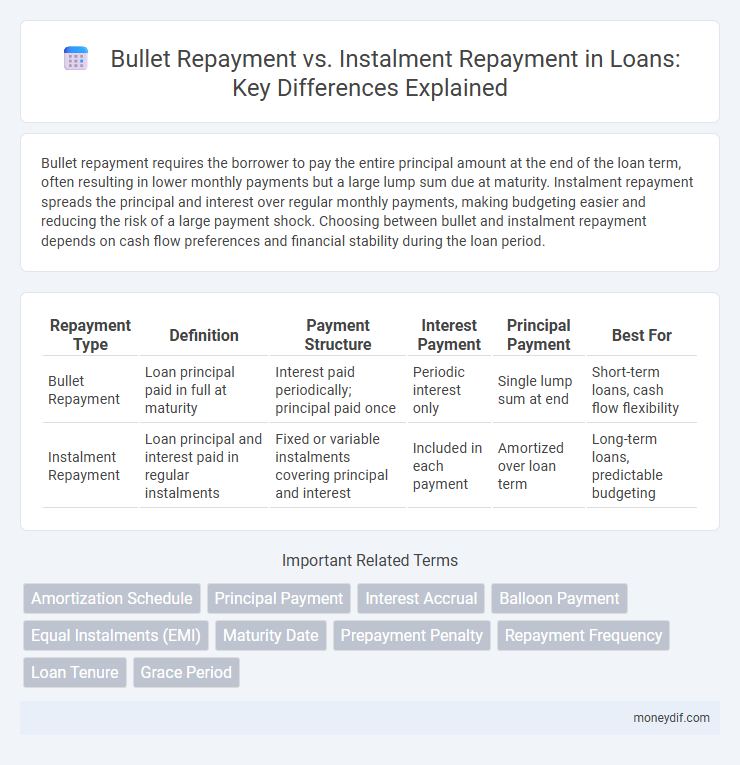

| Repayment Type | Definition | Payment Structure | Interest Payment | Principal Payment | Best For |

|---|---|---|---|---|---|

| Bullet Repayment | Loan principal paid in full at maturity | Interest paid periodically; principal paid once | Periodic interest only | Single lump sum at end | Short-term loans, cash flow flexibility |

| Instalment Repayment | Loan principal and interest paid in regular instalments | Fixed or variable instalments covering principal and interest | Included in each payment | Amortized over loan term | Long-term loans, predictable budgeting |

Understanding Bullet Repayment

Bullet repayment loans require the entire principal amount to be paid in one lump sum at the end of the loan term, while interest is usually paid periodically throughout the duration. This structure minimizes monthly payments but demands careful planning for the large final payment. Borrowers often choose bullet repayment for short-term financing or when expecting significant future cash inflows.

What is Instalment Repayment?

Instalment repayment is a loan repayment method where the borrower pays back the principal and interest in equal regular amounts over a set period, typically monthly. This structured payment plan helps borrowers manage cash flow and reduces the risk of default by spreading the loan burden evenly. Instalment loans include mortgages, auto loans, and personal loans, providing predictable repayment schedules and clear timelines for debt clearance.

Key Differences Between Bullet and Instalment Repayment

Bullet repayment requires the borrower to pay the entire principal amount in a single lump sum at the end of the loan term, while instalment repayment divides the principal and interest into regular, smaller payments over the loan period. Bullet loans typically have lower monthly obligations but higher risk of default due to the large final payment, whereas instalment loans spread out risk and improve cash flow management with predictable monthly payments. The choice between bullet and instalment repayment depends on the borrower's cash flow stability and ability to handle large one-time payments versus consistent budgets.

Pros and Cons of Bullet Repayment

Bullet repayment loans require a lump sum payment of the entire principal and interest at the end of the loan term, offering borrowers lower periodic payments and improved cash flow during the loan period. This structure reduces monthly financial burden but carries the risk of a large repayment amount at maturity, potentially leading to refinancing challenges or default if funds are unavailable. Compared to instalment repayments, bullet repayment lacks gradual principal reduction, increasing interest costs over time and demanding disciplined financial planning.

Advantages of Instalment Repayment

Instalment repayment allows borrowers to manage cash flow effectively by spreading loan principal and interest payments over a set period, reducing the financial burden of large lump-sum payments. This repayment method enhances budget predictability and financial planning, minimizing the risk of default due to manageable periodic payments. Financial institutions often prefer instalment loans as they provide consistent revenue streams and lower default rates compared to bullet repayment structures.

Interest Costs: Bullet vs Instalment Loans

Bullet repayment loans incur higher overall interest costs since the principal is repaid in full at maturity, causing interest to accumulate on the entire amount throughout the loan term. Instalment repayment loans reduce interest costs by gradually paying down the principal with each instalment, decreasing the outstanding balance and resulting interest over time. Borrowers seeking lower total interest expenses typically prefer instalment loans due to the continuous principal reduction during the repayment period.

Suitability: Which Borrower Should Choose Bullet Repayment?

Bullet repayment loans suit borrowers with irregular income or those expecting a lump sum payment, such as a business sale or inheritance, at loan maturity. This repayment structure is ideal for individuals who prefer lower monthly obligations and can manage a large lump sum payment at the end of the term. Borrowers seeking short-term financing with strong cash flow projections often benefit most from bullet repayment plans.

Suitability: Who Benefits from Instalment Repayment?

Instalment repayment suits borrowers seeking predictable monthly payments and manageable budgeting over time, such as salaried individuals and families with steady income streams. This method benefits those who prefer gradual debt reduction and want to avoid a large lump-sum payment at loan maturity. Instalments offer financial stability and reduce default risk by spreading principal and interest payments evenly throughout the loan tenure.

Impact on Cash Flow: Bullet vs Instalment Repayment

Bullet repayment loans require a single lump-sum payment of principal and interest at the end of the loan term, which can cause significant fluctuations in cash flow and potential liquidity challenges during repayment. Instalment repayment loans spread principal and interest payments evenly over the loan period, promoting consistent cash flow management and reducing the risk of large outflows in any single period. Businesses often prefer instalment repayment for predictable budgeting, while bullet repayment may suit those expecting substantial future inflows to cover the final payment.

Making the Right Choice: Factors to Consider

Choosing between bullet repayment and instalment repayment depends primarily on cash flow stability, loan purpose, and interest cost sensitivity. Bullet repayment suits borrowers expecting lump-sum inflows, offering lower total interest but requiring a large end payment, while instalment repayment spreads principal and interest evenly, minimizing risk and easing budgeting. Assessing income predictability, loan tenure, and financial discipline is crucial to align repayment method with long-term financial goals and affordability.

Important Terms

Amortization Schedule

An amortization schedule details the repayment structure, with bullet repayment requiring a lump sum at maturity, while installment repayment spreads principal and interest evenly throughout the loan term.

Principal Payment

Principal payment in bullet repayment involves a single lump sum paid at loan maturity, whereas instalment repayment distributes principal payments evenly over the loan term.

Interest Accrual

Interest accrual in bullet repayment loans accumulates on the principal until maturity, resulting in a lump-sum payment, whereas instalment repayment loans accrue interest continuously and require periodic payments reducing principal progressively.

Balloon Payment

Balloon payment is a large lump-sum payment due at the end of a loan term, contrasting with bullet repayment where the entire principal is paid once, and instalment repayment where the loan is paid back gradually through periodic payments.

Equal Instalments (EMI)

Equal Monthly Instalments (EMI) provide consistent repayment amounts over a loan tenure, contrasting with Bullet Repayment where the principal is paid in full at the end, reducing initial cash outflows but increasing total interest cost. Instalment Repayment structure balances principal and interest payments regularly, offering predictable budgeting and lower overall interest compared to Bullet Repayment.

Maturity Date

The maturity date marks the final deadline when the entire loan principal is due, typically associated with bullet repayment where a lump sum is paid at once. Instalment repayment schedules spread principal and interest payments evenly up to the maturity date, reducing the outstanding balance gradually over time.

Prepayment Penalty

Prepayment penalties are often higher for bullet repayment loans compared to instalment repayment loans due to the larger lump sum principal payment at loan maturity reducing lender interest income risk.

Repayment Frequency

Bullet repayment involves a single lump-sum payment at maturity, while instalment repayment requires periodic payments of principal and interest throughout the loan term.

Loan Tenure

Loan tenure impacts repayment strategies by determining whether borrowers opt for bullet repayment, which involves a lump-sum payment at maturity, or instalment repayment, which spreads payments evenly over the loan period.

Grace Period

Grace period extends the repayment start date, allowing bullet repayment to postpone principal payment until maturity, whereas instalment repayment requires periodic principal and interest payments during the grace period.

Bullet Repayment vs Instalment Repayment Infographic

moneydif.com

moneydif.com