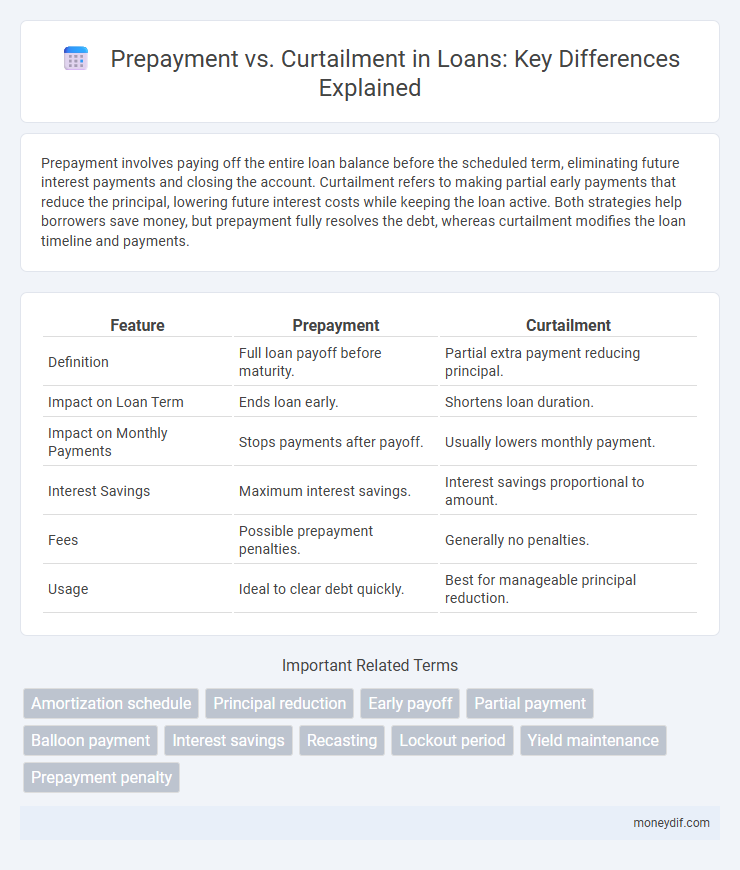

Prepayment involves paying off the entire loan balance before the scheduled term, eliminating future interest payments and closing the account. Curtailment refers to making partial early payments that reduce the principal, lowering future interest costs while keeping the loan active. Both strategies help borrowers save money, but prepayment fully resolves the debt, whereas curtailment modifies the loan timeline and payments.

Table of Comparison

| Feature | Prepayment | Curtailment |

|---|---|---|

| Definition | Full loan payoff before maturity. | Partial extra payment reducing principal. |

| Impact on Loan Term | Ends loan early. | Shortens loan duration. |

| Impact on Monthly Payments | Stops payments after payoff. | Usually lowers monthly payment. |

| Interest Savings | Maximum interest savings. | Interest savings proportional to amount. |

| Fees | Possible prepayment penalties. | Generally no penalties. |

| Usage | Ideal to clear debt quickly. | Best for manageable principal reduction. |

Understanding Loan Prepayment

Loan prepayment involves paying off a portion or the entirety of a loan before the scheduled due date, reducing the principal balance and the total interest paid over the loan term. This contrasts with curtailment, where extra payments specifically reduce the loan's principal without fully settling the loan early. Understanding loan prepayment options can help borrowers minimize interest costs and improve financial flexibility.

What is Loan Curtailment?

Loan curtailment refers to making additional payments toward the principal balance of a loan, reducing the overall loan term and interest paid. Unlike prepayment, which pays off the entire remaining loan balance early, curtailment partially reduces the principal without closing the loan account. This strategy accelerates debt payoff while maintaining regular loan payments, optimizing interest savings and financial flexibility.

Key Differences: Prepayment vs Curtailment

Prepayment involves paying off the entire outstanding loan balance before the scheduled end date, eliminating future interest payments and closing the loan early. Curtailment refers to making extra payments toward the principal without closing the loan, reducing the loan term and overall interest but maintaining the existing payment schedule. Both strategies impact interest savings and loan duration but differ in execution and financial flexibility.

Benefits of Prepaying Your Loan

Prepaying your loan significantly reduces the total interest paid over the life of the loan by shortening the principal balance faster than scheduled. This strategy improves your credit score by demonstrating responsible financial management and lowers monthly payment burdens, creating greater cash flow flexibility. Early repayment can also help borrowers avoid penalties and reduce overall debt, accelerating the path to financial freedom.

Advantages of Loan Curtailment

Loan curtailment reduces the outstanding principal balance, leading to lower interest payments over the life of the loan and a shorter loan term. Unlike prepayment penalties often associated with full prepayments, curtailments can minimize or eliminate penalty fees, providing a flexible way to decrease debt. This method enhances financial control by lowering monthly payments while accelerating equity buildup in the property.

Impact on Loan Tenure and EMI

Prepayment reduces the principal amount, directly shortening the loan tenure by decreasing the outstanding balance, while keeping the EMI unchanged unless recalculated. Curtailment specifically lowers the EMI by reducing the principal, allowing borrowers to maintain the original loan tenure but decrease monthly payments. Both strategies positively impact interest savings but differ: prepayment accelerates loan closure, whereas curtailment eases monthly financial burden.

Cost Implications: Fees and Charges

Prepayment of a loan often incurs prepayment penalties or fees that vary depending on the lender and loan agreement, potentially increasing the overall cost despite reducing interest expense. Curtailment, which involves making extra payments to reduce the principal without closing the loan, generally avoids hefty prepayment penalties but may still include administrative fees or charge limits set by the financial institution. Understanding the specific fee schedules and penalty structures in the loan terms is crucial for minimizing costs while accelerating repayment.

Tax Considerations for Prepayment and Curtailment

Tax considerations for prepayment and curtailment of loans differ significantly, impacting overall financial strategy. Prepayment may trigger prepayment penalties but can reduce future interest deductions on taxable income, whereas curtailment lowers the principal balance without fully paying off the loan, potentially preserving some interest tax benefits. Consult a tax professional to evaluate how accelerated loan payments affect deductibility under IRS rules and maximize tax efficiency.

When to Choose Prepayment Over Curtailment

Choosing prepayment over curtailment is ideal when you want to reduce the total interest paid by paying off a significant portion or the entire loan principal ahead of schedule. Prepayment benefits borrowers with large lump sums aiming to eliminate debt faster and lower overall borrowing costs, especially on high-interest loans. Curtailment suits those seeking to reduce monthly installments without shortening the loan term, whereas prepayment accelerates loan closure and maximizes interest savings.

Tips for Managing Loan Repayment Efficiently

Prepayment reduces the principal balance by paying extra amounts ahead of schedule, minimizing overall interest costs and shortening loan tenure. Curtailment involves making partial payments toward the principal during scheduled installments, effectively lowering monthly payments or loan duration. Prioritize clear communication with lenders about prepayment terms, avoid penalties, and maintain a consistent repayment plan to optimize loan management and save on interest.

Important Terms

Amortization schedule

An amortization schedule details loan repayment with principal and interest over time, while prepayment involves paying extra outside the schedule to reduce principal faster, potentially lowering interest costs. Curtailment specifically refers to partial prepayments that shorten the loan term, unlike general prepayments that may only reduce monthly payments without changing the loan duration.

Principal reduction

Principal reduction involves paying down the outstanding loan balance faster, impacting both prepayment and curtailment strategies; prepayment typically refers to paying the full remaining balance ahead of schedule, while curtailment means making extra payments to reduce future interest without settling the entire loan. This distinction is crucial for managing mortgage amortization schedules, minimizing interest costs, and improving overall loan efficiency.

Early payoff

Early payoff involves settling a loan before its scheduled term, with prepayment referring to paying off the entire remaining balance, while curtailment means making partial payments to reduce the principal. Both strategies reduce interest costs, but prepayment eliminates future payments entirely, whereas curtailment shortens the loan duration or lowers monthly payments incrementally.

Partial payment

Partial payment refers to paying a portion of the outstanding loan balance, which can either be categorized as prepayment or curtailment depending on how it affects the loan terms. Prepayment reduces the loan principal ahead of schedule, potentially shortening the loan term, while curtailment lowers the monthly payment amount without changing the loan duration.

Balloon payment

A balloon payment refers to a large, lump-sum payment due at the end of a loan term, often affecting prepayment and curtailment strategies; prepayment involves paying off the entire remaining balance early, while curtailment reduces the principal with partial payments without closing the loan. Understanding the differences helps borrowers manage interest costs and loan longevity effectively.

Interest savings

Interest savings from prepayment occur when the borrower pays off the entire loan balance early, eliminating future interest payments completely, whereas curtailment involves making extra payments toward the principal to reduce the loan term or monthly payments, resulting in partial interest savings over time. Prepayment typically leads to greater overall interest reduction due to full loan payoff, while curtailment provides flexible management of debt with incremental savings.

Recasting

Recasting adjusts the loan balance and monthly payments after a substantial prepayment without changing the loan term, while curtailment involves making extra payments specifically to reduce the principal and shorten the loan duration. Prepayments reduce the principal directly and can trigger recasting if the lender offers it, whereas curtailment focuses solely on accelerating payoff by consistently applying additional amounts toward the principal.

Lockout period

The lockout period imposes a timeframe during which prepayment of a loan is prohibited, impacting borrower flexibility by restricting early full repayment. In contrast, curtailment allows partial principal reduction without triggering penalties during the lockout period, enabling borrowers to lower interest costs while maintaining loan terms.

Yield maintenance

Yield maintenance ensures lenders receive full expected interest by imposing a prepayment penalty that compensates for lost yield, contrasting with curtailment which reduces the principal without a penalty, thereby lowering future interest payments. This mechanism aligns borrower incentives with lender cash flow expectations, preserving loan profitability despite early repayment.

Prepayment penalty

Prepayment penalty is a fee charged by lenders when borrowers pay off their loan balance early through prepayment, which differs from curtailment where borrowers make extra payments to reduce the principal without fully settling the loan. Understanding the distinction is crucial as prepayment can trigger penalties reducing cost savings, while curtailment typically avoids such fees and accelerates loan payoff.

Prepayment vs Curtailment Infographic

moneydif.com

moneydif.com