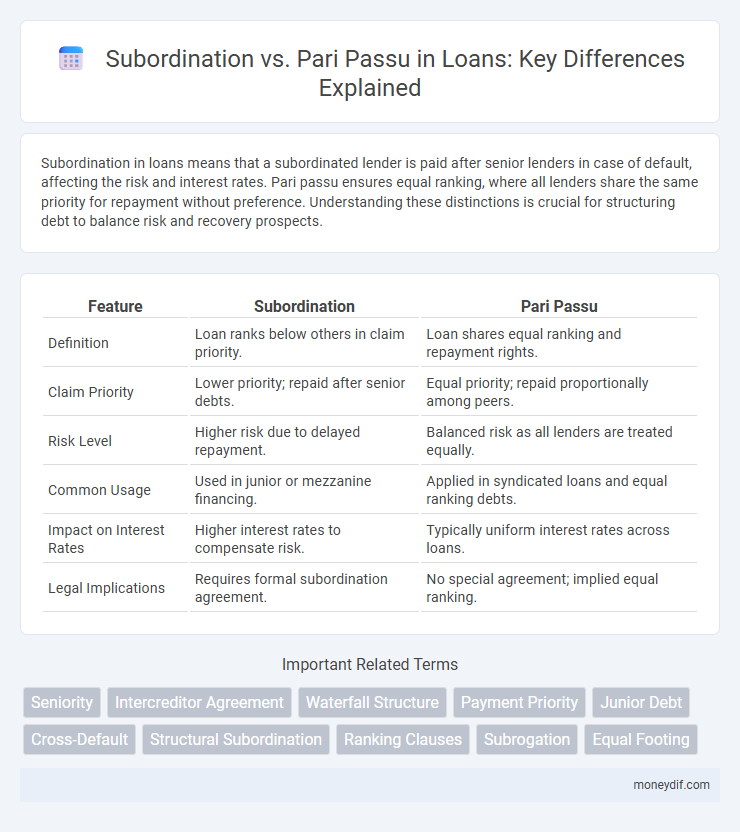

Subordination in loans means that a subordinated lender is paid after senior lenders in case of default, affecting the risk and interest rates. Pari passu ensures equal ranking, where all lenders share the same priority for repayment without preference. Understanding these distinctions is crucial for structuring debt to balance risk and recovery prospects.

Table of Comparison

| Feature | Subordination | Pari Passu |

|---|---|---|

| Definition | Loan ranks below others in claim priority. | Loan shares equal ranking and repayment rights. |

| Claim Priority | Lower priority; repaid after senior debts. | Equal priority; repaid proportionally among peers. |

| Risk Level | Higher risk due to delayed repayment. | Balanced risk as all lenders are treated equally. |

| Common Usage | Used in junior or mezzanine financing. | Applied in syndicated loans and equal ranking debts. |

| Impact on Interest Rates | Higher interest rates to compensate risk. | Typically uniform interest rates across loans. |

| Legal Implications | Requires formal subordination agreement. | No special agreement; implied equal ranking. |

Understanding Subordination in Loan Agreements

Subordination in loan agreements establishes a ranking hierarchy where subordinated loans are repaid only after senior debt obligations are satisfied, affecting the lender's risk exposure and recovery priority. This structure influences credit terms, interest rates, and borrower leverage, as subordinated debt carries higher risk due to its lower claim in default scenarios. Understanding subordination clauses is crucial for lenders and borrowers to evaluate debt priority, enforceability, and implications on financial restructuring.

What Does Pari Passu Mean in Lending?

Pari passu in lending refers to the equal ranking of multiple loans or creditors, meaning they share the same priority for repayment without any preference. This concept ensures that all parties receive proportionate payments if the borrower defaults or undergoes liquidation. Unlike subordination, which ranks loans in a hierarchical order, pari passu loans are treated equally under the terms of the agreement.

Key Differences Between Subordination and Pari Passu

Subordination establishes a hierarchy of loan repayments, where subordinated debt is paid after senior debt, increasing the risk for junior lenders but often allowing for higher interest rates. Pari passu means equal ranking of loans, ensuring that all creditors share repayments proportionally and no lender has priority over another. The key difference lies in repayment priority and risk allocation, affecting borrower flexibility and lender protection.

Legal Implications of Loan Subordination

Loan subordination establishes a legal hierarchy where junior creditors agree to defer repayment rights until senior lenders are fully paid, impacting enforcement priorities in default scenarios. Subordination agreements must be precisely drafted to clarify rights and obligations, preventing disputes over payment order and collateral claims. Failure to properly document subordination can lead to protracted litigation, affecting recovery rates and creditor relationships.

Pari Passu Clauses: Structure and Significance

Pari Passu clauses ensure that multiple lenders share equal ranking in repayment priority without any preference or subordination, maintaining balanced risk among creditors. This structure is vital in syndicated loans and bond issuances, as it prevents preferential treatment and enables seamless debt restructuring. The clear articulation of pari passu status in loan agreements enhances creditor confidence and facilitates orderly enforcement during defaults.

Impact on Lenders: Subordination vs Pari Passu

Subordination affects lenders by ranking their claims below senior debt, increasing risk of delayed or reduced recovery in default situations. Pari passu ensures lenders share equal priority on repayments and collateral, promoting balanced risk distribution among creditors. The choice between subordination and pari passu impacts lender confidence, refinancing options, and overall credit terms.

Priority of Claims in Debt Repayment

Subordination in loans means a creditor's claim ranks below other debts, impacting the priority of claims in debt repayment during defaults or liquidation. Pari Passu agreements establish equal priority among creditors, ensuring proportional repayment without preference. Understanding these distinctions is crucial for assessing risk and structuring debt hierarchies in financial agreements.

Real-World Examples: Subordination and Pari Passu

In real-world loan agreements, subordination typically occurs when a junior loan ranks below senior debt, as seen in mezzanine financing where junior lenders receive repayment only after senior creditors are fully paid. Pari passu arrangements ensure equal ranking among creditors, common in syndicated loans where lenders share identical rights and claims on collateral. Understanding these distinctions is crucial for risk assessment and prioritization of repayments in corporate debt restructuring.

Advantages and Risks of Subordination

Subordination in loan agreements allows junior lenders to defer their claim priority, enhancing the appeal of senior debt by reducing perceived risk and potentially lowering interest rates. This structure facilitates access to capital for borrowers by attracting diverse investors but exposes subordinated lenders to heightened default risk and delayed repayment. Careful assessment of the subordination clause is essential for understanding the impact on recovery prospects and overall credit risk.

When to Choose Pari Passu Over Subordination

Choose pari passu over subordination when equal ranking among creditors ensures balanced risk distribution and simplifies debt restructuring processes. Pari passu clauses are ideal in syndicated loans where lenders seek proportional repayment rights without priority disputes. This structure enhances transparency and reduces negotiation complexity during borrower default or refinancing events.

Important Terms

Seniority

Seniority determines the order of debt repayment, where subordinated debt ranks below senior debt, whereas pari passu debt holders share equal payment priority.

Intercreditor Agreement

An Intercreditor Agreement clearly defines the priority of debt repayment by establishing whether lenders' claims are subordinated or ranked pari passu, ensuring orderly debt restructuring and default management.

Waterfall Structure

The Waterfall Structure prioritizes subordination by sequentially allocating cash flows to senior creditors before junior ones, contrasting with pari passu arrangements where creditors share payments proportionally and simultaneously.

Payment Priority

Payment priority determines whether debts are subordinated, ranking below other obligations, or pari passu, sharing equal ranking and payment rights among creditors.

Junior Debt

Junior debt holds a lower repayment priority than pari passu debt, ranking subordinated in the capital structure during insolvency or liquidation events.

Cross-Default

Cross-default clauses trigger immediate debt obligations when a borrower defaults on any subsidiary debt, impacting subordination agreements that prioritize creditor claims differently than pari passu arrangements, which treat all creditors equally in ranking.

Structural Subordination

Structural subordination occurs when a subsidiary's debt ranks behind its parent company's debt, contrasting with pari passu debt which holds equal seniority across creditors.

Ranking Clauses

Ranking clauses establish the priority of claims in insolvency, clarifying whether debts rank pari passu or are subordinated to other obligations.

Subrogation

Subrogation grants a creditor the right to step into another's shoes to claim priority on a debt, whereas subordination agreements intentionally rank one creditor below another, and pari passu ensures equal ranking among creditors.

Equal Footing

Equal footing ensures parties hold pari passu status, preventing legal subordination in claims and rights hierarchy.

Subordination vs Pari Passu Infographic

moneydif.com

moneydif.com