Cross-collateralization involves using multiple assets as collateral to secure a single loan, enhancing lender protection by reducing risk through diversified security interests. Cross-default clauses trigger a default on one loan if the borrower defaults on another, allowing lenders to protect themselves from broader credit risks. Understanding the distinction between these mechanisms is crucial for managing multi-loan agreements and minimizing financial exposure.

Table of Comparison

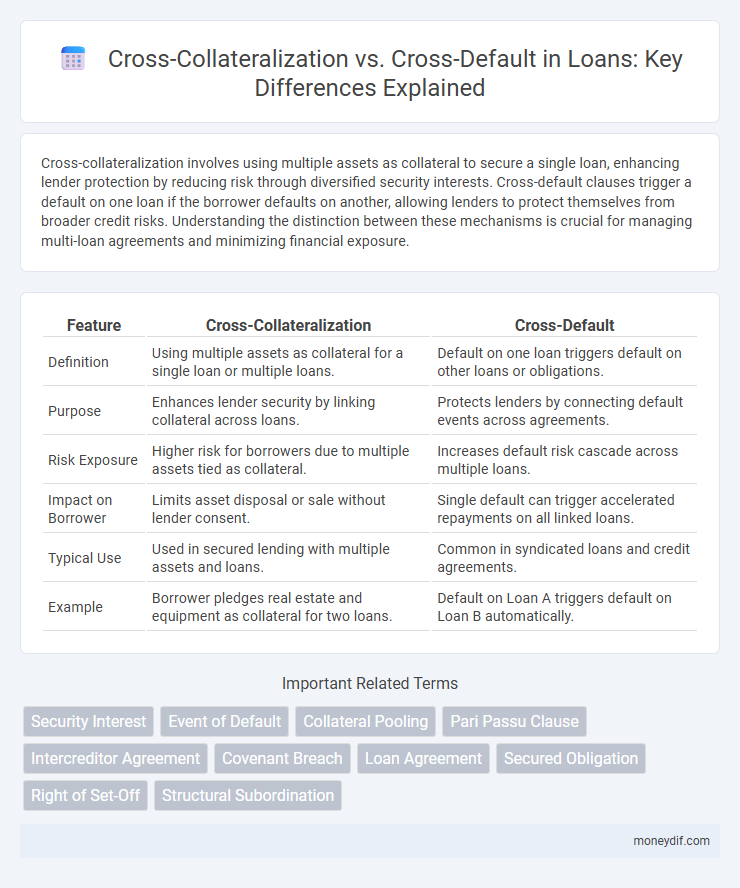

| Feature | Cross-Collateralization | Cross-Default |

|---|---|---|

| Definition | Using multiple assets as collateral for a single loan or multiple loans. | Default on one loan triggers default on other loans or obligations. |

| Purpose | Enhances lender security by linking collateral across loans. | Protects lenders by connecting default events across agreements. |

| Risk Exposure | Higher risk for borrowers due to multiple assets tied as collateral. | Increases default risk cascade across multiple loans. |

| Impact on Borrower | Limits asset disposal or sale without lender consent. | Single default can trigger accelerated repayments on all linked loans. |

| Typical Use | Used in secured lending with multiple assets and loans. | Common in syndicated loans and credit agreements. |

| Example | Borrower pledges real estate and equipment as collateral for two loans. | Default on Loan A triggers default on Loan B automatically. |

Cross-Collateralization vs Cross-Default: Key Differences

Cross-collateralization involves using one asset as security for multiple loans, enhancing lender security by linking collateral across obligations. Cross-default triggers a default declaration on one loan if a borrower defaults on another, protecting lenders from cascading risks. These mechanisms differ in scope: cross-collateralization ties assets directly, while cross-default links default events to safeguard creditor interests.

How Cross-Collateralization Works in Loans

Cross-collateralization in loans involves using multiple assets to secure a single loan or multiple loans, increasing the lender's assurance by placing a lien on several pieces of collateral. This method enhances creditworthiness by allowing borrowers to leverage additional assets beyond the primary collateral, potentially resulting in better loan terms or higher loan amounts. Unlike cross-default, which triggers default if one loan under multiple agreements falls behind, cross-collateralization directly ties the security interest to multiple assets, minimizing lender risk.

Understanding the Cross-Default Clause in Loan Agreements

The cross-default clause in loan agreements triggers a default if the borrower fails to meet obligations on any other loan, protecting lenders from increased credit risk. Unlike cross-collateralization, which involves securing multiple loans with the same collateral, cross-default focuses on the borrower's overall credit events rather than collateral ties. This clause strengthens lender control by linking loan agreements, ensuring timely repayments and risk mitigation across financial obligations.

Legal Implications of Cross-Collateralization

Cross-collateralization legally binds multiple loan obligations to a single collateral asset, increasing the lender's security interest and potentially complicating borrower's asset recovery in default scenarios. This practice requires precise contract drafting to avoid ambiguities in lien priorities and enforceability under applicable state or federal laws. Courts often scrutinize cross-collateralization clauses for fairness and compliance, making legal counsel essential to mitigate risks of litigation and ensure clear debtor-creditor rights.

Risks Associated with Cross-Default Provisions

Cross-default provisions increase the risk of triggering multiple loan defaults from a single missed payment, magnifying financial distress for the borrower. These provisions create interconnected liabilities, potentially leading to accelerated debt repayment demands across various loans. Lenders must carefully assess credit exposure to avoid cascading defaults that can destabilize borrower creditworthiness and complicate debt restructuring efforts.

Benefits of Cross-Collateralization for Lenders

Cross-collateralization enhances lender security by allowing multiple loans to be secured with a single asset, reducing the risk of default and improving recovery rates. It streamlines the collateral management process and increases the lender's leverage in negotiations, enabling more flexible and efficient loan portfolios. This method also facilitates access to higher loan amounts and better interest terms for borrowers, indirectly benefiting lenders through strengthened borrower relationships and reduced credit risk.

Borrower Risks: Navigating Cross-Default Triggers

Cross-default clauses increase borrower risk by triggering a default if any loan within a portfolio defaults, potentially accelerating repayment demands across multiple debts. Cross-collateralization ties various loans to the same collateral, amplifying the risk of losing assets if one loan defaults. Borrowers must carefully assess these provisions to avoid systemic financial pressures and asset seizure.

Real-World Examples: Cross-Collateralization and Cross-Default

Cross-collateralization involves using one asset to secure multiple loans, which can be seen in real estate where a borrower's home and investment property back different mortgages. Cross-default clauses appear in corporate financing, such as when missing a payment on one loan triggers a default on all related loans, exemplified in leveraged buyouts and syndicated loan agreements. Companies often negotiate these terms to manage risk exposure and protect lenders across interconnected credit facilities.

Protecting Borrowers: Negotiating Loan Terms

Cross-collateralization involves using multiple assets as security for a single loan, increasing the lender's protection but potentially putting more borrower assets at risk. Cross-default clauses trigger a default if the borrower misses payments on any linked loan, which can accelerate debt repayment demands across loans. Borrowers should negotiate to limit cross-collateralization scope and modify cross-default provisions to protect their assets and avoid cascading defaults.

Choosing Between Cross-Collateralization and Cross-Default Provisions

Cross-collateralization involves using multiple assets as collateral for a single loan, increasing lender security and potentially lowering interest rates but raising borrower risk if multiple assets are seized. Cross-default provisions trigger default if a borrower misses payments on any related loan, protecting lenders by linking obligations across agreements without securing specific assets. Choosing between these terms depends on prioritizing asset protection versus default risk management, balancing borrower flexibility against lender security.

Important Terms

Security Interest

Security interest in cross-collateralization involves using the same collateral to secure multiple loans, enhancing creditor claims across obligations. Cross-default clauses trigger default under one agreement to activate default provisions in others, strengthening lender protection without sharing collateral backing.

Event of Default

Event of Default clauses in cross-collateralization agreements trigger enforcement rights when pledged collateral secures multiple obligations, increasing risk exposure compared to cross-default provisions that activate default consequences across related debts without necessarily involving shared collateral. Cross-collateralization tightly links financial obligations through asset pledges, while cross-default provisions broaden default triggers based on borrower payment failures across separate loan agreements.

Collateral Pooling

Collateral pooling enhances credit risk management by combining multiple assets to secure a single obligation, contrasting with cross-collateralization where one asset guarantees multiple debts. Cross-default clauses trigger default across agreements upon one default event, distinct from collateral pooling's asset aggregation strategy to optimize collateral use and reduce liquidity strain.

Pari Passu Clause

The Pari Passu clause ensures that multiple creditors have equal rights to collateral without priority, which contrasts with cross-collateralization where a single collateral secures multiple debts, potentially subordinating others. Cross-default triggers default if a borrower defaults on any related debt, while Pari Passu maintains equal ranking among creditors regardless of multiple secured obligations.

Intercreditor Agreement

An Intercreditor Agreement defines the rights and priorities among multiple creditors, particularly addressing cross-collateralization where the same collateral secures multiple loans, enhancing lender protection. Cross-default provisions trigger default status on one loan if another loan defaults, increasing risk interdependency without directly affecting collateral claims.

Covenant Breach

Covenant breach occurs when a borrower violates terms set in a loan agreement, often triggering remedies related to cross-default or cross-collateralization clauses that tie multiple loans or assets together. Cross-default provisions automatically accelerate repayment if a breach occurs in one loan, while cross-collateralization uses collateral from multiple agreements to secure debt, intensifying creditor protection and borrower risk.

Loan Agreement

Loan agreements often incorporate cross-collateralization clauses to secure multiple loans with shared assets, enhancing creditor protection by allowing collateral from one loan to cover defaults on another. Cross-default provisions trigger a default on one loan if another related loan defaults, increasing lender leverage but potentially amplifying borrower risk across multiple borrowing agreements.

Secured Obligation

Secured obligations involve assets pledged as collateral, reducing lender risk by prioritizing repayment in case of default, while cross-collateralization links multiple loans to shared collateral, enhancing recovery options. Cross-default clauses trigger a default if any related loan defaults, increasing risk exposure across agreements without necessarily involving shared collateral.

Right of Set-Off

The right of set-off allows a creditor to offset mutual debts with a debtor, which differs from cross-collateralization that involves securing one loan with collateral from another loan, while cross-default triggers default consequences across multiple agreements if one defaults. Cross-collateralization enhances creditor security by linking collateral, whereas cross-default links performance obligations without altering collateral arrangements.

Structural Subordination

Structural subordination occurs when debt issued by a parent company is prioritized over debt issued by its subsidiaries, affecting creditor claims in bankruptcy. Cross-collateralization ties assets of different borrowers as security for a loan, whereas cross-default provisions trigger default if any related loan defaults, both influencing creditor recovery rights differently.

cross-collateralization vs cross-default Infographic

moneydif.com

moneydif.com