Syndicated loans involve multiple lenders jointly providing a large loan to a single borrower, sharing the risk and structuring the credit under a single agreement. Participated loans occur when the original lender sells portions of the loan to other financial institutions, allowing for risk distribution without forming a new loan agreement. Both methods enhance lending capacity and risk management but differ in legal structure and administrative complexity.

Table of Comparison

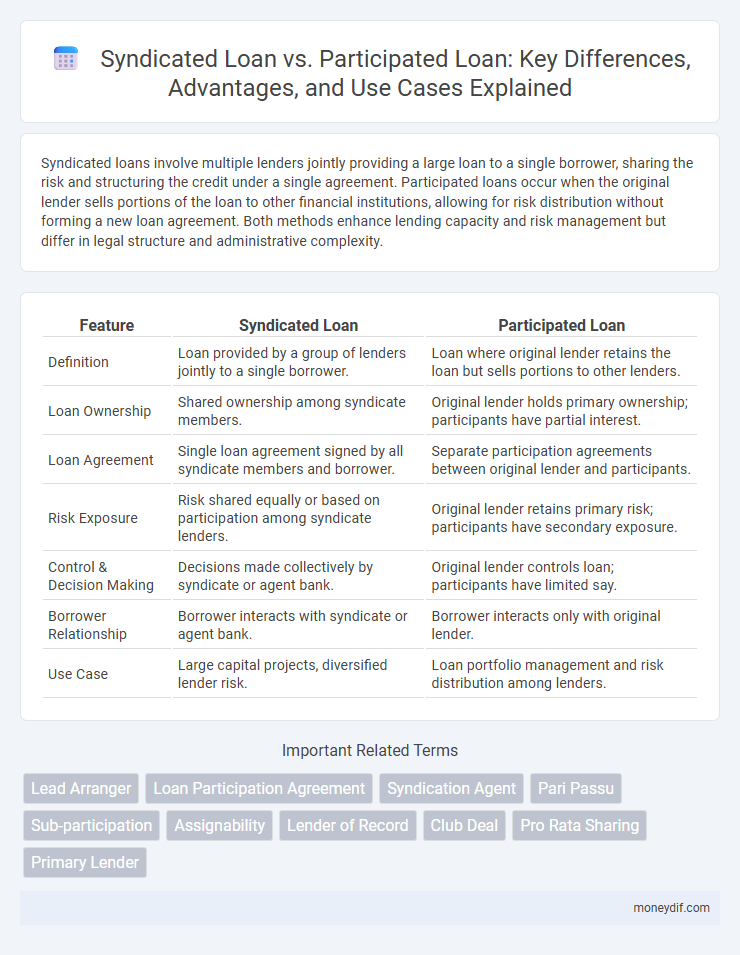

| Feature | Syndicated Loan | Participated Loan |

|---|---|---|

| Definition | Loan provided by a group of lenders jointly to a single borrower. | Loan where original lender retains the loan but sells portions to other lenders. |

| Loan Ownership | Shared ownership among syndicate members. | Original lender holds primary ownership; participants have partial interest. |

| Loan Agreement | Single loan agreement signed by all syndicate members and borrower. | Separate participation agreements between original lender and participants. |

| Risk Exposure | Risk shared equally or based on participation among syndicate lenders. | Original lender retains primary risk; participants have secondary exposure. |

| Control & Decision Making | Decisions made collectively by syndicate or agent bank. | Original lender controls loan; participants have limited say. |

| Borrower Relationship | Borrower interacts with syndicate or agent bank. | Borrower interacts only with original lender. |

| Use Case | Large capital projects, diversified lender risk. | Loan portfolio management and risk distribution among lenders. |

Syndicated Loan vs Participated Loan: Key Differences

Syndicated loans involve multiple lenders jointly providing a large loan to a single borrower, sharing both risk and administrative responsibilities, while participated loans consist of a primary lender distributing portions of the loan to secondary lenders without direct borrower involvement. Syndicated loans typically feature a lead bank coordinating terms, underwriting, and repayment schedules, enhancing credit opportunities for large-scale borrowers. Participated loans mainly serve to spread loan exposure among financial institutions, where the original lender maintains control over the loan servicing and borrower relationship.

Understanding Syndicated Loans

Syndicated loans involve multiple lenders jointly providing a borrower a large loan, distributing risk and resources efficiently. These loans are arranged by one or more lead banks that structure and manage the credit facility, ensuring coordinated loan disbursement and repayment. Understanding syndicated loans is crucial for accessing substantial capital while benefiting from shared lender expertise and risk diversification.

What Is a Participated Loan?

A participated loan involves multiple lenders sharing portions of a single loan extended to a borrower, where one lender initially funds the entire amount and then sells participation interests to others. This arrangement allows lenders to diversify risk and increase lending capacity without issuing separate loans. Participated loans differ from syndicated loans primarily in structure and management, as participated loans usually lack a formal syndicate or lead arranger coordinating the process.

Structure and Process Comparison

Syndicated loans involve multiple lenders jointly providing a large loan to a single borrower, structured with a lead arranger managing the negotiation, documentation, and administration processes. In contrast, participated loans begin with a primary lender who originates the loan and subsequently sells portions of the credit exposure to other financial institutions, maintaining direct control over the loan management. The syndicated loan process emphasizes collaborative syndicate formation and shared risk, while participated loans prioritize individual lender involvement with secondary loan participation agreements defining rights and responsibilities.

Roles of Lenders in Both Loan Types

In syndicated loans, lenders act as a unified group led by a lead arranger who coordinates loan terms and disburses funds, sharing risks and returns proportionately. Participated loans involve a primary lender who originates and manages the loan while selling portions of the credit exposure to participant lenders without altering the loan terms. The lead lender in syndicated loans has a governance role, whereas participant lenders primarily receive interest income with limited administrative responsibilities.

Risk Distribution in Syndicated and Participated Loans

Syndicated loans distribute risk among multiple lenders by dividing the loan into portions that each participant funds, reducing individual exposure and enhancing credit risk management. Participated loans involve a primary lender who maintains the loan relationship and risk, while participants purchase portions of the loan, sharing credit risk but often retaining limited control. Risk distribution in syndicated loans tends to be more balanced and transparent, whereas participated loans concentrate control and operational risk with the originating lender despite risk sharing.

Documentation and Legal Framework

Syndicated loans involve a single loan agreement under a unified legal framework, where all participating lenders share the same terms and collective decision-making processes, ensuring consistency and streamlined documentation. Participated loans operate through individual loan agreements between the borrower and each participant, leading to varied contractual terms and a more complex legal structure with decentralized control. The documentation for syndicated loans is typically more standardized and governed by syndicated loan agreements, while participated loans require multiple sets of tailored contracts reflecting each participant's distinct rights and obligations.

Benefits of Syndicated Loans

Syndicated loans offer borrowers access to larger capital amounts by pooling resources from multiple lenders, reducing individual risk exposure. This structure provides enhanced flexibility in loan terms and facilitates complex financing needs for large projects or acquisitions. Syndicated loans also improve borrower credibility and can streamline the administrative process through a single lead arranger managing communications.

Advantages of Participated Loans

Participated loans provide enhanced flexibility by allowing multiple lenders to share the loan risk without the complexity of managing a formal syndicate, making them easier to administer. These loans facilitate quicker decision-making processes and reduce legal and administrative costs compared to syndicated loans. Borrowers benefit from streamlined negotiations and potentially faster funding, while lenders gain diversified exposure with simplified documentation.

Choosing Between Syndicated and Participated Loans

Choosing between syndicated and participated loans depends on the size and complexity of the financing needed, with syndicated loans involving multiple lenders jointly providing a large loan under a single agreement, offering centralized management and reduced risk exposure. Participated loans involve one primary lender originating the loan and then selling portions of the loan to other participants, which allows for flexibility but requires coordination among separate agreements. Assessing borrower needs, lender risk tolerance, and administrative capabilities determines the optimal structure for shared lending arrangements.

Important Terms

Lead Arranger

The lead arranger in syndicated loans organizes the loan structure, coordinating multiple lenders to collectively fund a large credit facility, while in participated loans, the lead lender originates the loan and sells portions to other financial institutions without forming a formal syndicate. Syndicated loans typically involve complex negotiations and shared risk management among participants, whereas participated loans permit secondary institutions to invest with less management responsibility.

Loan Participation Agreement

A Loan Participation Agreement outlines the terms under which a lender transfers ownership interests in a syndicated loan to other financial institutions, enabling risk distribution without originating new loans. Syndicated loans involve multiple lenders directly funding a single borrower, whereas participated loans involve one lender selling portions of its existing loan to participants while maintaining the original borrower relationship.

Syndication Agent

A Syndication Agent coordinates the distribution of syndicated loans by managing communication and documentation between lenders and the borrower, ensuring efficient loan allocation and compliance. Unlike participated loans, where a lender sells portions of a loan to other institutions without direct borrower involvement, syndicated loans involve a structured group of lenders led by the Syndication Agent to share credit risk and loan administration.

Pari Passu

Pari passu in syndicated loans ensures all lenders share equal rank and rights in collateral and repayment, maintaining proportional risk and return across the syndicate. In participated loans, however, the lead lender holds primary responsibility and control while participants have indirect rights, potentially creating differences in priority and exposure compared to pari passu arrangements.

Sub-participation

Sub-participation in syndicated loans involves a third party obtaining an interest in a portion of a lender's commitment without direct contractual relationship with the borrower, enhancing risk distribution. Participated loans differ as the originator sells portions of the loan to participants, who hold direct rights and obligations under the loan agreement.

Assignability

Assignability in syndicated loans typically allows lenders to transfer their loan portions to other qualified investors with lender consent, enhancing liquidity and risk distribution. In contrast, participations are generally non-assignable because the originating lender retains the direct relationship with the borrower while sharing loan benefits with participants.

Lender of Record

The Lender of Record in syndicated loans is the primary entity legally recognized as the lender to the borrower, responsible for loan administration and servicing, while in participated loans, the Lender of Record remains the original lender who holds the contractual relationship with the borrower despite sharing credit risk and loan proceeds with participants. This distinction impacts loan documentation, regulatory reporting, and the flow of payments in syndicated loan facilities versus participated loan arrangements.

Club Deal

A Club Deal involves a group of banks collectively providing a syndicated loan, sharing both the risk and administrative responsibilities, whereas a participated loan typically features one lender originating the loan and then selling portions to other financial institutions without joint underwriting. Syndicated loans in Club Deals offer broader capital access and collaborative decision-making, while participated loans emphasize individual lender risk transfer without altering borrower terms.

Pro Rata Sharing

Pro Rata Sharing in syndicated loans ensures each lender receives repayments and interest proportionate to their contributed share, maintaining balanced risk and return across the syndicate. In contrast, participated loans involve a lead lender extending credit while selling portions to participants without proportionate repayment sharing, often resulting in a more creditor-centric allocation of cash flows.

Primary Lender

Primary lenders in syndicated loans coordinate multiple financial institutions to collectively finance large-scale projects, maintaining direct responsibility for the loan administration and borrower relationship. In contrast, participated loans involve a primary lender who originates the loan and subsequently sells portions of the credit risk to one or more participant lenders without altering the loan's original terms.

Syndicated loan vs Participated loan Infographic

moneydif.com

moneydif.com