A floating rate loan features an interest rate that fluctuates based on market benchmarks, offering potential savings when rates decline but exposing borrowers to higher costs if rates rise. In contrast, a fixed rate loan maintains a constant interest rate throughout the loan term, providing predictable monthly payments and stability in budgeting. Borrowers must weigh the trade-off between the certainty of fixed rates and the flexibility of floating rates when selecting the ideal loan structure.

Table of Comparison

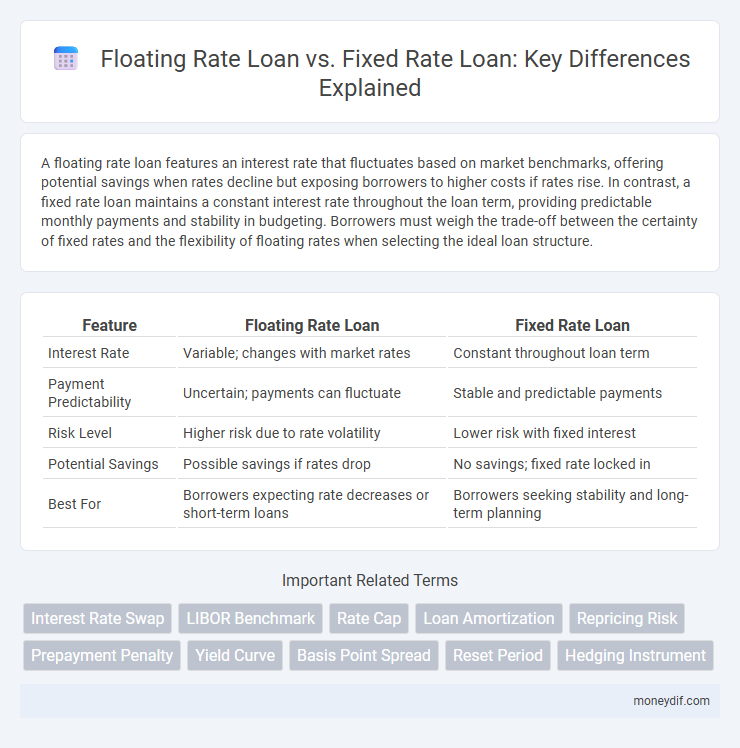

| Feature | Floating Rate Loan | Fixed Rate Loan |

|---|---|---|

| Interest Rate | Variable; changes with market rates | Constant throughout loan term |

| Payment Predictability | Uncertain; payments can fluctuate | Stable and predictable payments |

| Risk Level | Higher risk due to rate volatility | Lower risk with fixed interest |

| Potential Savings | Possible savings if rates drop | No savings; fixed rate locked in |

| Best For | Borrowers expecting rate decreases or short-term loans | Borrowers seeking stability and long-term planning |

Introduction to Floating Rate and Fixed Rate Loans

Floating rate loans feature interest rates that adjust periodically based on benchmark indices like LIBOR or SOFR, offering borrowers protection against rising rates while exposing them to potential payment fluctuations. Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and stability in budgeting. Understanding the differences between floating and fixed rate loans is essential for selecting the appropriate financing strategy aligned with market conditions and risk tolerance.

Key Differences Between Floating and Fixed Rate Loans

Floating rate loans feature interest rates that adjust periodically based on market benchmarks such as LIBOR or SOFR, leading to variable monthly repayments and potential cost savings when rates decline. Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable payment schedules and protection against rising rates. Key differences include rate variability, payment stability, and risk exposure, with floating rate loans exposing borrowers to interest rate fluctuations, while fixed rate loans offer certainty at potentially higher initial costs.

How Floating Rate Loans Work

Floating rate loans have interest rates that adjust periodically based on a reference benchmark, such as the LIBOR or SOFR, plus a fixed margin defined in the loan agreement. The periodic rate resets expose borrowers to interest rate fluctuations, impacting monthly payments and overall borrowing costs. This structure benefits borrowers when market rates decline but increases financial risk if rates rise significantly during the loan term.

How Fixed Rate Loans Work

Fixed rate loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and stable budgeting for borrowers. The fixed rate is determined at the loan's inception based on market conditions, credit score, and loan duration, protecting against interest rate fluctuations. This stability makes fixed rate loans ideal for long-term borrowing, especially when interest rates are expected to rise.

Pros and Cons of Floating Rate Loans

Floating rate loans offer borrowers the advantage of typically lower initial interest rates compared to fixed rate loans, providing cost savings when benchmark rates remain stable or decrease. These loans expose borrowers to interest rate fluctuations, increasing payment uncertainty and potential financial risk when market rates rise. They are suitable for borrowers expecting short-term financing or anticipating declining interest rates, but can lead to higher overall costs during periods of rate hikes.

Pros and Cons of Fixed Rate Loans

Fixed rate loans offer the advantage of predictable monthly payments, protecting borrowers from interest rate fluctuations and simplifying budget planning. However, these loans often come with higher initial interest rates compared to floating rate loans, potentially resulting in increased overall borrowing costs if market rates remain stable or decline. Fixed rate loans lack flexibility, making refinancing or early repayment less attractive due to potential penalties and the inability to benefit from falling interest rates.

Factors to Consider When Choosing Loan Types

Interest rate volatility significantly impacts the choice between floating rate loans and fixed rate loans, with floating rates offering potential savings during periods of declining rates but posing risks of increased payments when rates rise. Borrowers should assess their risk tolerance, financial stability, and future income projections to determine the suitability of each loan type. Economic forecasts, loan tenure, and market interest rate trends also play crucial roles in selecting the most advantageous loan structure.

Impact of Interest Rate Trends on Loan Selection

Floating rate loans adjust interest payments based on prevailing market rates, making them advantageous during periods of declining interest rates but risky when rates rise. Fixed rate loans offer stability with consistent payments, benefiting borrowers anticipating increasing interest rates or seeking budgeting certainty. Selecting between floating and fixed rate loans depends heavily on expected interest rate trends and individual risk tolerance.

Who Should Choose Floating vs Fixed Rate Loans?

Borrowers with fluctuating incomes or expecting interest rates to decline benefit from floating rate loans, as these loans offer lower initial interest rates that adjust with market conditions. Fixed rate loans suit those seeking payment stability and budget certainty, especially in a rising interest rate environment. Businesses with predictable cash flows often prefer fixed rates to avoid the risk of increased repayments, while individuals or companies comfortable with risk may opt for floating rates to capitalize on potential savings.

Conclusion: Choosing the Best Loan Option for You

Choosing between a floating rate loan and a fixed rate loan depends on your risk tolerance and market outlook. Floating rate loans offer lower initial interest rates with potential savings if market rates decline, but carry the risk of rising payments. Fixed rate loans provide payment stability and protection against interest rate fluctuations, making them ideal for borrowers seeking predictable budgeting.

Important Terms

Interest Rate Swap

Interest rate swaps allow borrowers to exchange floating rate loan payments for fixed rate loan payments, managing interest rate risk effectively.

LIBOR Benchmark

LIBOR benchmark rates directly influence floating rate loans' interest payments by adjusting periodically, while fixed rate loans maintain consistent interest regardless of LIBOR fluctuations.

Rate Cap

Rate caps limit interest costs on floating rate loans by setting a maximum rate, offering protection against rate hikes unlike fixed rate loans which maintain constant interest regardless of market fluctuations.

Loan Amortization

Loan amortization schedules for floating rate loans fluctuate with interest rate changes, whereas fixed rate loans maintain consistent payments throughout the loan term.

Repricing Risk

Repricing risk arises in floating rate loans due to interest rate adjustments at each reset date, whereas fixed rate loans eliminate this risk by locking in a constant interest rate over the loan term.

Prepayment Penalty

Prepayment penalties on floating rate loans often differ from fixed rate loans, as floating rate loans typically have lower or no penalties due to interest rate variability, whereas fixed rate loans usually impose higher penalties to compensate for predictable interest income loss.

Yield Curve

The yield curve influences the cost difference between floating rate loans, which adjust with interest rate changes, and fixed rate loans, which maintain a constant interest rate over the loan term.

Basis Point Spread

Basis point spread measures the difference in interest rates between floating rate loans and fixed rate loans, reflecting credit risk, market conditions, and borrower profile.

Reset Period

The reset period in floating rate loans determines the frequency of interest rate adjustments based on a reference index, unlike fixed rate loans which maintain a constant interest rate throughout the term.

Hedging Instrument

A hedging instrument such as an interest rate swap is used to convert floating rate loan payments into fixed rate payments, stabilizing cash flows and mitigating interest rate risk.

Floating Rate Loan vs Fixed Rate Loan Infographic

moneydif.com

moneydif.com