Repricing a loan involves adjusting the interest rate or terms within the existing loan agreement, often to reflect market changes, without changing the loan structure. Refinancing replaces the original loan with a new one, typically to secure better terms, lower interest rates, or a different repayment period. Choosing between repricing and refinancing depends on cost-effectiveness, the borrower's credit profile, and the desired financial outcome.

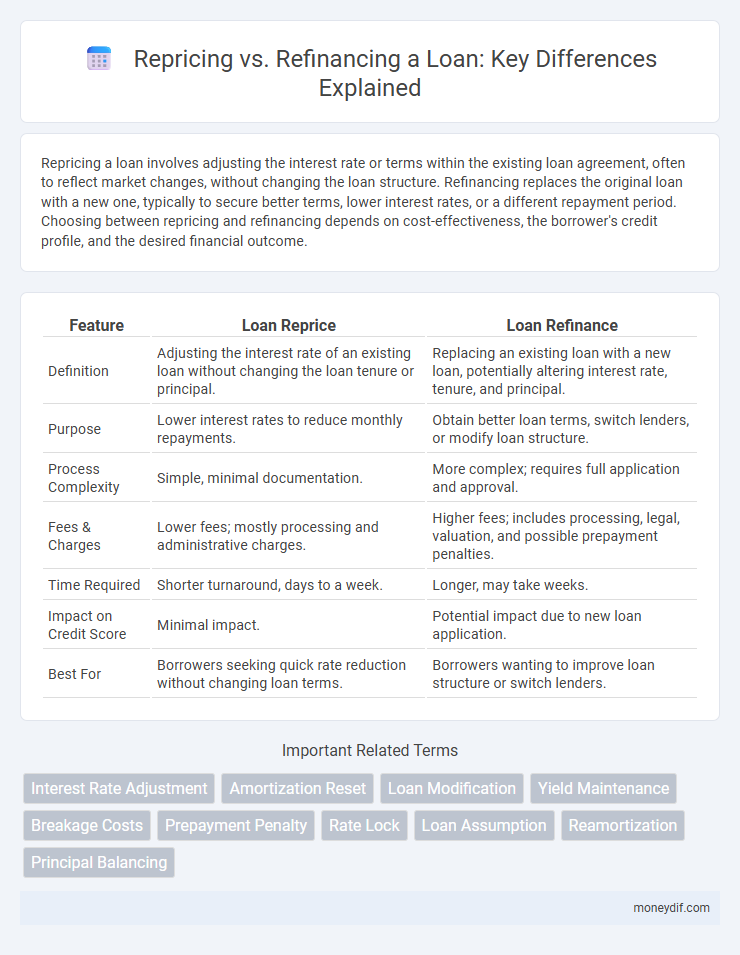

Table of Comparison

| Feature | Loan Reprice | Loan Refinance |

|---|---|---|

| Definition | Adjusting the interest rate of an existing loan without changing the loan tenure or principal. | Replacing an existing loan with a new loan, potentially altering interest rate, tenure, and principal. |

| Purpose | Lower interest rates to reduce monthly repayments. | Obtain better loan terms, switch lenders, or modify loan structure. |

| Process Complexity | Simple, minimal documentation. | More complex; requires full application and approval. |

| Fees & Charges | Lower fees; mostly processing and administrative charges. | Higher fees; includes processing, legal, valuation, and possible prepayment penalties. |

| Time Required | Shorter turnaround, days to a week. | Longer, may take weeks. |

| Impact on Credit Score | Minimal impact. | Potential impact due to new loan application. |

| Best For | Borrowers seeking quick rate reduction without changing loan terms. | Borrowers wanting to improve loan structure or switch lenders. |

Understanding Loan Repricing vs Refinancing

Loan repricing adjusts the interest rate or terms of an existing loan without issuing a new loan agreement, often triggered by market rate changes or borrower risk profile. Refinancing involves replacing the original loan with a new loan, typically to secure better rates, lower monthly payments, or different loan durations. Understanding the differences helps borrowers evaluate cost-effectiveness, credit impact, and potential savings for optimal financial management.

Key Differences Between Repricing and Refinancing

Repricing a loan involves adjusting the interest rate or terms of an existing loan agreement without creating a new contract, often to reflect current market rates, while refinancing replaces the original loan with a new one, potentially altering the principal, term, and lender. Repricing typically incurs lower fees and minimal paperwork compared to refinancing, which can involve substantial closing costs and credit assessments. The choice between repricing and refinancing depends on factors like interest rate movements, loan balance, borrower creditworthiness, and desired changes to loan structure.

When Should You Consider Loan Repricing?

Loan repricing should be considered when market interest rates have significantly decreased since you originally secured your loan, enabling reduced monthly payments without changing the loan term. It is optimal when your current lender offers more favorable interest terms, avoiding the costs and paperwork associated with refinancing. Assessing credit score improvements and current loan conditions can also indicate the financial benefit of repricing over refinancing.

When Is Loan Refinancing the Better Option?

Loan refinancing is the better option when interest rates have significantly dropped since the original loan was made, allowing borrowers to secure lower monthly payments or reduce the loan term. It is ideal for improving cash flow or consolidating high-interest debt into more manageable payments. Refinancing also benefits those seeking to switch from adjustable-rate to fixed-rate loans for more predictable budgeting.

Pros and Cons of Repricing Your Loan

Repricing your loan can lower your interest rate without changing the loan tenure or terms, resulting in immediate savings on monthly payments and overall interest costs. It typically involves lower fees and less paperwork compared to refinancing, making it a quicker and more cost-effective option. However, repricing may not always provide the lowest possible rate available in the market, and lenders might impose eligibility criteria or restrict refinancing benefits, limiting potential financial gains.

Pros and Cons of Refinancing Your Loan

Refinancing your loan can lower interest rates, reduce monthly payments, and improve cash flow, making it a strategic choice for borrowers seeking financial relief. However, refinancing often involves upfront costs such as closing fees, appraisal charges, and potential prepayment penalties, which may outweigh the benefits if the original loan terms are favorable. Evaluating the break-even point and long-term savings is essential to determine if refinancing aligns with your financial goals and market conditions.

Impact on Interest Rates: Reprice vs Refinance

Repricing a loan involves adjusting the interest rate within the existing loan term, typically aligning it with current market rates without changing the loan structure, resulting in potentially lower rates with minimal fees. Refinancing replaces the original loan with a new one, often offering more significant interest rate reductions but may incur closing costs and reset the loan term. The impact on interest rates is that repricing provides a quicker, cost-effective way to benefit from lower rates, while refinancing offers a strategic option for longer-term savings despite higher upfront expenses.

Costs and Fees: What to Expect from Each Option

Loan repricing typically involves lower upfront costs and fees compared to refinancing, as it modifies existing loan terms without initiating a new loan process. Refinancing often incurs higher expenses, including application fees, appraisal fees, and potential prepayment penalties, due to the comprehensive evaluation of a new loan agreement. Borrowers should carefully compare the total costs and fees of each option to determine the most cost-effective solution for their financial situation.

How to Decide Between Repricing and Refinancing

Deciding between repricing and refinancing a loan depends on current interest rates, loan terms, and overall financial goals. Repricing allows for adjusting the interest rate without changing the loan tenure or principal, making it ideal for borrowers seeking lower monthly payments without additional costs. Refinancing involves replacing the existing loan with a new one, potentially offering better rates and terms but often incurring fees and requiring credit evaluation.

Common Mistakes to Avoid with Repricing or Refinancing

Common mistakes to avoid with loan repricing include failing to compare interest rates thoroughly and neglecting to review the terms for hidden fees or penalties. When refinancing, borrowers often overlook the impact of closing costs and extended loan terms that can increase overall expenses despite lower monthly payments. Understanding the full financial implications and conducting detailed cost-benefit analyses can prevent costly errors in both repricing and refinancing decisions.

Important Terms

Interest Rate Adjustment

Interest rate adjustment involves modifying the existing loan terms either through repricing or refinancing to reflect current market rates; repricing adjusts the interest rate within the original loan structure, while refinancing replaces the original loan with a new one, often extending the term or changing the principal. Repricing is typically faster and less costly, but refinancing offers more flexibility in loan terms and can result in lower overall costs depending on borrower creditworthiness and market conditions.

Amortization Reset

Amortization reset adjusts the loan's principal repayment schedule without altering the interest rate, distinguishing it from repricing, which modifies the interest rate terms. Unlike refinancing, which replaces the existing loan with a new one often involving new terms and fees, amortization reset maintains the original loan structure while extending or adjusting payment periods.

Loan Modification

Loan modification adjusts existing loan terms to improve borrower affordability without replacing the original loan, while refinancing replaces the current loan with a new one, often offering a different interest rate or loan structure. Repricing involves changing the interest rate within the existing loan framework, typically as part of a loan modification, whereas refinancing resets the loan balance, term, and rate under a new agreement.

Yield Maintenance

Yield maintenance ensures lenders receive the full expected yield by imposing a prepayment penalty that compensates for lost interest income, making it a cost-effective alternative to refinancing. Repricing adjusts the loan's interest rate based on current market conditions without changing the loan structure, whereas refinancing involves replacing the original loan with new terms, often incurring higher costs due to yield maintenance fees.

Breakage Costs

Breakage costs refer to the financial penalties or losses incurred when refinancing a loan before its maturity, often triggered by the difference between the original interest rate and current market rates during reprice or refinance actions. These costs impact the decision-making process by influencing whether repricing an existing loan or refinancing with a new loan is more cost-effective for both lenders and borrowers.

Prepayment Penalty

A prepayment penalty is a fee charged by lenders when a borrower pays off a loan early, often impacting decisions between repricing and refinancing. Repricing adjusts the loan interest rate without altering the loan structure, typically avoiding prepayment penalties, whereas refinancing replaces the original loan with a new one, which may trigger penalty fees depending on the loan terms.

Rate Lock

Rate lock secures a borrower's interest rate for a specified period, preventing rate fluctuations during the loan process, while repricing typically adjusts the interest rate within an existing loan without refinancing. Refinance involves replacing the original loan with a new loan, often to obtain a lower rate or better terms, whereas repricing modifies the current loan agreement without initiating a new loan.

Loan Assumption

Loan assumption allows a buyer to take over the seller's existing mortgage under the original terms, often resulting in lower costs compared to refinancing, which involves replacing the old loan with a new one at current interest rates. Repricing adjusts the interest rate on an existing loan without changing the loan amount or terms, providing a cost-effective alternative to refinancing but lacking the ownership transfer benefits of loan assumption.

Reamortization

Reamortization adjusts the loan balance and recalculates payments without changing the loan term, making it distinct from refinancing, which replaces the old loan with a new one often at a different interest rate or term. Unlike repricing, which solely changes the interest rate based on market conditions or loan terms, reamortization can reduce monthly payments by spreading the remaining balance over the remaining loan period.

Principal Balancing

Principal balancing in mortgage lending occurs when a lender adjusts the principal balance of a loan during a reprice, aligning the loan terms without altering the original amortization schedule, unlike refinancing which involves replacing the existing loan with a new one that could change the principal, interest rate, and loan duration. This approach minimizes closing costs and avoids credit requalification, making principal balancing a cost-effective strategy for borrowers seeking lower rates without the complexities of full refinancing.

Reprice vs Refinance Infographic

moneydif.com

moneydif.com