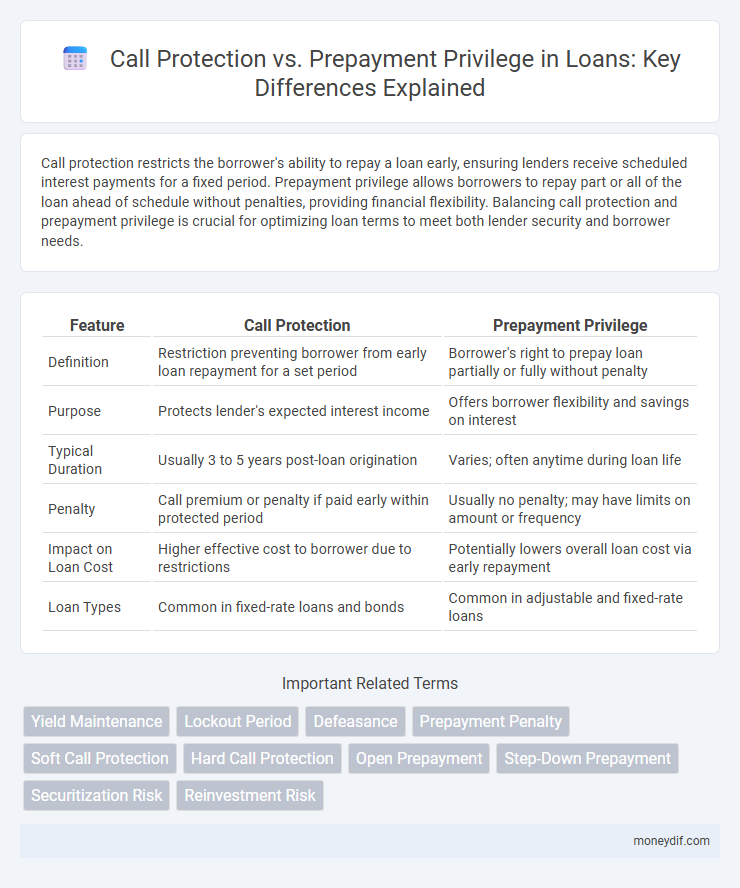

Call protection restricts the borrower's ability to repay a loan early, ensuring lenders receive scheduled interest payments for a fixed period. Prepayment privilege allows borrowers to repay part or all of the loan ahead of schedule without penalties, providing financial flexibility. Balancing call protection and prepayment privilege is crucial for optimizing loan terms to meet both lender security and borrower needs.

Table of Comparison

| Feature | Call Protection | Prepayment Privilege |

|---|---|---|

| Definition | Restriction preventing borrower from early loan repayment for a set period | Borrower's right to prepay loan partially or fully without penalty |

| Purpose | Protects lender's expected interest income | Offers borrower flexibility and savings on interest |

| Typical Duration | Usually 3 to 5 years post-loan origination | Varies; often anytime during loan life |

| Penalty | Call premium or penalty if paid early within protected period | Usually no penalty; may have limits on amount or frequency |

| Impact on Loan Cost | Higher effective cost to borrower due to restrictions | Potentially lowers overall loan cost via early repayment |

| Loan Types | Common in fixed-rate loans and bonds | Common in adjustable and fixed-rate loans |

Understanding Call Protection in Loan Agreements

Call protection in loan agreements safeguards lenders by restricting borrowers from repaying the loan before a specified date or under certain conditions, thereby ensuring predictable interest income. This feature often includes penalties or fees if early repayment occurs within the call protection period. Understanding these terms is crucial for borrowers to assess potential costs and for lenders to manage credit risk effectively.

What Is Prepayment Privilege?

Prepayment privilege allows borrowers to repay all or part of a loan before its scheduled due date without incurring penalties, enhancing financial flexibility and reducing interest costs. This feature contrasts with call protection, which restricts lenders from demanding early repayment, ensuring stable returns. Understanding prepayment privileges helps borrowers optimize loan management and minimize overall borrowing expenses.

Key Differences Between Call Protection and Prepayment Privilege

Call protection restricts borrowers from repaying loans before a specified period without penalty, ensuring lenders receive interest income as agreed, while prepayment privilege allows borrowers to repay loans early with little or no penalty, offering flexibility to reduce interest costs. The key difference lies in the balance of risk and benefit; call protection favors lenders by limiting early repayment, whereas prepayment privilege benefits borrowers by enabling early payoff. Understanding these terms is critical in loan agreements to assess financial impact and repayment options accurately.

How Call Protection Benefits Lenders

Call protection benefits lenders by ensuring predictable cash flow through restrictions on early loan repayments, reducing reinvestment risk during periods of fluctuating interest rates. It safeguards the lender's expected yield by deterring borrowers from refinancing when market rates decline, maintaining the original loan terms. This protection enhances loan portfolio stability and supports accurate financial forecasting for lenders.

Advantages of Prepayment Privilege for Borrowers

Prepayment privilege offers borrowers significant advantages by allowing early loan repayment without penalties, reducing overall interest costs and shortening the loan term. This flexibility enhances financial control, enabling borrowers to capitalize on improved cash flow or refinancing opportunities. Compared to call protection, which limits early repayment, prepayment privilege promotes savings and greater debt management freedom.

Common Types of Call Protection Clauses

Common types of call protection clauses include lockout periods, which prohibit prepayment for a specified time, and call premiums, requiring borrowers to pay a fee for early repayment. Step-down call protection gradually reduces fees over time, balancing lender risk and borrower flexibility. These clauses ensure lenders maintain expected returns while giving borrowers predetermined options for loan prepayment.

Prepayment Penalties: What Borrowers Should Know

Prepayment penalties are fees charged when a borrower repays a loan earlier than agreed, impacting overall loan cost and flexibility. Call protection limits the lender's ability to demand early repayment, while prepayment privileges allow borrowers to pay off loans partially or fully without penalties within specific terms. Understanding the terms of prepayment penalties helps borrowers avoid unexpected costs and strategize loan repayment efficiently.

Balancing Lender Risk and Borrower Flexibility

Call protection clauses limit a borrower's ability to repay a loan early, safeguarding lender returns by reducing prepayment risk and maintaining steady interest income. Prepayment privilege provisions offer borrowers the flexibility to refinance or reduce debt without penalties, enhancing borrowing attractiveness and financial agility. Striking the right balance between call protection and prepayment privileges optimizes loan agreements to align lender risk tolerance with borrower needs for adaptable repayment options.

Real-World Examples of Call Protection and Prepayment Privilege

Call protection clauses in commercial real estate loans often include fixed periods, such as five years, during which prepayment penalties apply, incentivizing borrowers to maintain the loan to protect lender returns. A common example is a commercial mortgage with a 3-year call protection period, where prepayment triggers yield maintenance fees equivalent to the interest lost by the lender. In contrast, prepayment privilege features, like those in many residential mortgage loans, allow borrowers to prepay without penalty after an initial lockout period, providing flexibility for refinancing when interest rates drop.

Choosing the Right Loan: Factors to Consider

Call protection limits a lender's ability to demand early repayment, providing borrowers with financial stability and predictable interest expenses throughout the loan term. Prepayment privilege offers flexibility, allowing borrowers to reduce interest costs by paying off the loan early without penalties. Evaluating your cash flow needs, risk tolerance, and long-term financial goals helps determine whether call protection or prepayment privilege aligns best with your loan strategy.

Important Terms

Yield Maintenance

Yield maintenance ensures lenders receive full scheduled interest by imposing a prepayment penalty that limits the borrower's prepayment privilege and acts as a call protection mechanism.

Lockout Period

Lockout Period restricts prepayment privilege by enforcing call protection, preventing early loan repayment within a specified timeframe to safeguard investor returns.

Defeasance

Defeasance mitigates risks associated with prepayment privilege by substituting scheduled principal payments with government securities, thereby preserving call protection for bondholders.

Prepayment Penalty

Prepayment penalty imposes financial charges on borrowers for early loan repayment, balancing call protection that restricts issuer redemption with prepayment privilege allowing borrowers flexibility to repay without penalties.

Soft Call Protection

Soft Call Protection limits the lender's risk by restricting early loan repayments within a defined period, contrasting with Prepayment Privilege that allows borrowers flexibility to repay without penalties.

Hard Call Protection

Hard Call Protection restricts early bond redemption during a specified period, ensuring investors receive full call premium, unlike Prepayment Privilege which allows issuer flexibility to repay debt earlier without such strict limitations.

Open Prepayment

Open Prepayment allows borrowers to repay loans early without penalties, contrasting with Call Protection that restricts early repayment to protect lenders, while Prepayment Privilege provides limited rights for borrowers to prepay certain portions of a loan before maturity.

Step-Down Prepayment

Step-Down Prepayment reduces call protection by allowing borrowers to prepay loans at decreasing penalty levels, balancing lender security with borrower flexibility.

Securitization Risk

Securitization risk increases when call protection weakens, as prepayment privileges allow borrowers to repay loans early, potentially disrupting expected cash flows.

Reinvestment Risk

Reinvestment risk increases for bondholders when call protection expires, allowing issuers to exercise prepayment privilege and refinance at lower interest rates.

Call Protection vs Prepayment Privilege Infographic

moneydif.com

moneydif.com